In the complex ecosystem of corporate finance, precision is not just a virtue—it’s a necessity. At the heart of this precision lies a critical process known as general ledger reconciliation. This fundamental practice serves as the backbone of financial integrity, ensuring that an organization’s financial records accurately reflect its true economic position.

Understanding General Ledger Reconciliation

General ledger reconciliation is the meticulous process of verifying that the balances in an organization’s general ledger—the master record of all financial transactions—align with the actual financial activities of the business. This process involves comparing internal records with external documents such as bank statements, invoices, and other financial instruments to ensure consistency and accuracy.

The Stakes Are High

The importance of this process cannot be overstated. Consider this sobering statistic from the Association of Certified Fraud Examiners (ACFE): organizations lose an average of 5% of their annual revenues to fraud, with a median loss per case of $125,000. These figures underscore the critical role that meticulous financial oversight, including thorough general ledger reconciliation, plays in safeguarding an organization’s financial health.

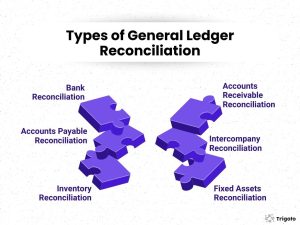

Types of General Ledger Reconciliation

General ledger reconciliation is not a one-size-fits-all process. Different aspects of an organization’s finances require specific reconciliation approaches:

- Bank Reconciliation: This fundamental process aligns the transactions in your general ledger with those on your bank statements. It’s crucial for detecting discrepancies, identifying potential fraud, and ensuring accurate cash flow management.

- Accounts Receivable Reconciliation: By verifying the amounts owed to your business by customers, this process helps maintain healthy cash flow and prompts timely follow-ups on outstanding payments.

- Accounts Payable Reconciliation: This ensures that your recorded payables match what you actually owe vendors and suppliers, helping maintain good relationships and avoid late payment penalties.

- Intercompany Reconciliation: For businesses with multiple entities or subsidiaries, this process ensures accurate elimination of intercompany transactions in consolidated financial statements.

- Inventory Reconciliation: By comparing recorded inventory values with physical counts, this process helps identify discrepancies, manage stock levels efficiently, and control costs.

- Fixed Assets Reconciliation: This ensures that the recorded value of fixed assets matches their actual value, crucial for accurate depreciation calculations and financial reporting.

The Importance of General Ledger Reconciliation

The benefits of diligent general ledger reconciliation extend far beyond mere number-matching:

- Financial Integrity: It serves as a safeguard against errors and fraud, ensuring the accuracy of financial records.

- Informed Decision-Making: Accurate financial data is the foundation of sound strategic planning and budgeting.

- Regulatory Compliance: Regular reconciliation helps ensure adherence to accounting standards and tax laws.

- Audit Readiness: A well-reconciled general ledger provides a clear audit trail, simplifying the audit process.

- Cost Control: By identifying discrepancies early, businesses can prevent financial losses and optimize resource allocation.

Best Practices for Effective General Ledger Reconciliation

To maximize the benefits of this crucial process, consider implementing these best practices:

- Embrace Automation: Leverage cutting-edge reconciliation software to reduce manual errors and increase efficiency. Automation can handle large volumes of transactions with greater speed and accuracy than manual processes.

- Implement Segregation of Duties: Distribute reconciliation responsibilities among team members to ensure checks and balances, reducing the risk of errors or fraud.

- Conduct Regular Reviews: Periodically assess your reconciliation processes to identify inefficiencies and areas for improvement.

- Invest in Continuous Training: Keep your finance team updated on the latest reconciliation techniques and tools through ongoing training programs.

- Maintain Compliance Focus: Stay abreast of regulatory requirements and accounting standards, ensuring your reconciliation processes align with current regulations.

- Document Meticulously: Maintain detailed records of your reconciliation processes, findings, and resolutions. This documentation is invaluable for audits and future reference.

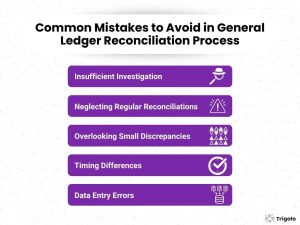

Common Mistakes to Avoid

Even with best practices in place, certain errors can creep into the reconciliation process. Be vigilant against:

- Data Entry Errors: Simple mistakes like typos or transposition errors can lead to significant discrepancies.

- Timing Differences: Ensure you’re comparing transactions from the same time period in your ledger and external documents.

- Overlooking Small Discrepancies: Even minor differences can indicate larger issues and should be investigated thoroughly.

- Neglecting Regular Reconciliations: Delaying reconciliations can allow errors to accumulate, making the process more challenging over time.

- Insufficient Investigation: Don’t just correct discrepancies—understand why they occurred to prevent future issues.

The Future of General Ledger Reconciliation

As we look to the future, the landscape of general ledger reconciliation is evolving. Artificial Intelligence (AI) and Machine Learning (ML) are poised to revolutionize this critical process, offering:

- Predictive Analytics: AI can forecast potential discrepancies before they occur, allowing for proactive financial management.

- Pattern Recognition: ML algorithms can identify unusual transaction patterns that might indicate fraud or errors.

- Continuous Reconciliation: Advanced systems can perform real-time reconciliation, providing up-to-the-minute financial accuracy.

Conclusion: The Cornerstone of Financial Health

General ledger reconciliation is more than a routine accounting task—it’s the foundation of financial integrity and strategic decision-making. By understanding its importance, implementing best practices, and leveraging emerging technologies, organizations can ensure their financial records accurately reflect their economic reality.

In an era where financial missteps can have far-reaching consequences, mastering the art and science of general ledger reconciliation is not just advisable—it’s imperative. It’s the key to unlocking financial clarity, maintaining stakeholder trust, and positioning your organization for sustainable success in an increasingly complex business landscape.

Remember, in the world of corporate finance, accuracy is not just about getting the numbers right—it’s about getting the future right. And it all starts with a meticulously reconciled general ledger.